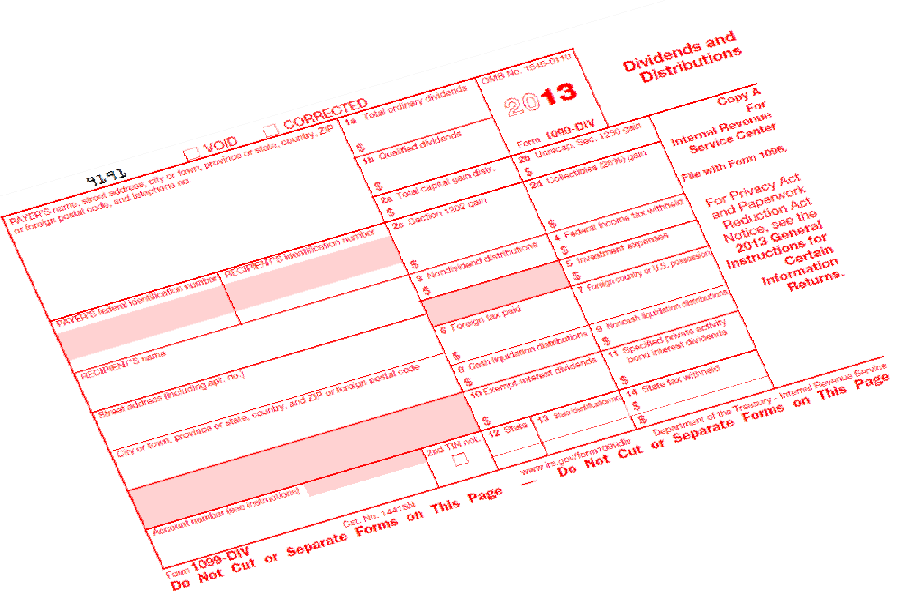

Form 1099 Dividends and Distributions is an IRS form that is used to report dividends and other distributions payments to investors. Dividends reported on 1099-DIV forms can include dividends paid, capital gains dividends, and exempt-interest dividends. The form reports the total amount paid by the bank or financial institution to an investor during the course of a year. This form is also used to report other tax items related to dividends and distributions, such as Section 1250 Gain, Section 1202 Gain, investment expenses, foreign tax paid, and federal tax withheld.

Bank and other financial institutions must file form 1099-DIV with the IRS for each investor to whom they have paid dividends during the year, whether on paper or electronically. The financial institution must also provide a statement to the recipient to whom the dividend is paid.

|

|

Any organization which has paid dividends, withheld foreign tax on dividends and distributions, or withheld federal tax under the backup withholding rules must use this form.

Who needs to file Form 1099-DIV?

The Internal Revenue Services requires most payments of dividends and distributions to be reported on tax form 1099-DIV by the person or entity that makes the payments. Most commonly, banks and other financial institutions or government agencies making dividend payments are the ones needing this form.

When is this form filed?

An organization is required to file if they:

- Paid dividends (including capital gain dividends and exempt-interest dividends) and other distributions on stocks of $10 or more

- Paid $600 or more as part of a liquidation

- Paid or withheld any foreign tax on dividends and other distributions on stock

- Withheld any federal income tax on dividends under the backup withholding rules

What is the deadline to file Form 1099-DIV?

The deadline to file this form with the IRS is end of February if filing on paper. If filing electronically then the deadline is end of March. However, the deadline to provide recipient copy is end of January.

Click

here

for more information on deadline.

What is the penalty for failure to file Form 1099-DIV?

The IRS imposes heavy penalties if a business fails to file or fails to file correct information. There is a penalty for not providing recipient copies. The penalty increases with time. So, even if you have not filed your form in time, we encourage you to file as soon as possible.

Click

here

for more information of penalties.

|